Our Investment Process: Approach

Portfolio designs should not be static and need to be dynamically rebalanced with shifts in underlying macro-economic cycles. This rebalancing in accordance with shifting economic conditions is of paramount importance to generating superior investment performance for our clients. We believe Artemis is uniquely qualified in this regard because of our extensive background in global markets, macro-economic analysis capabilities, and unique client affiliations.

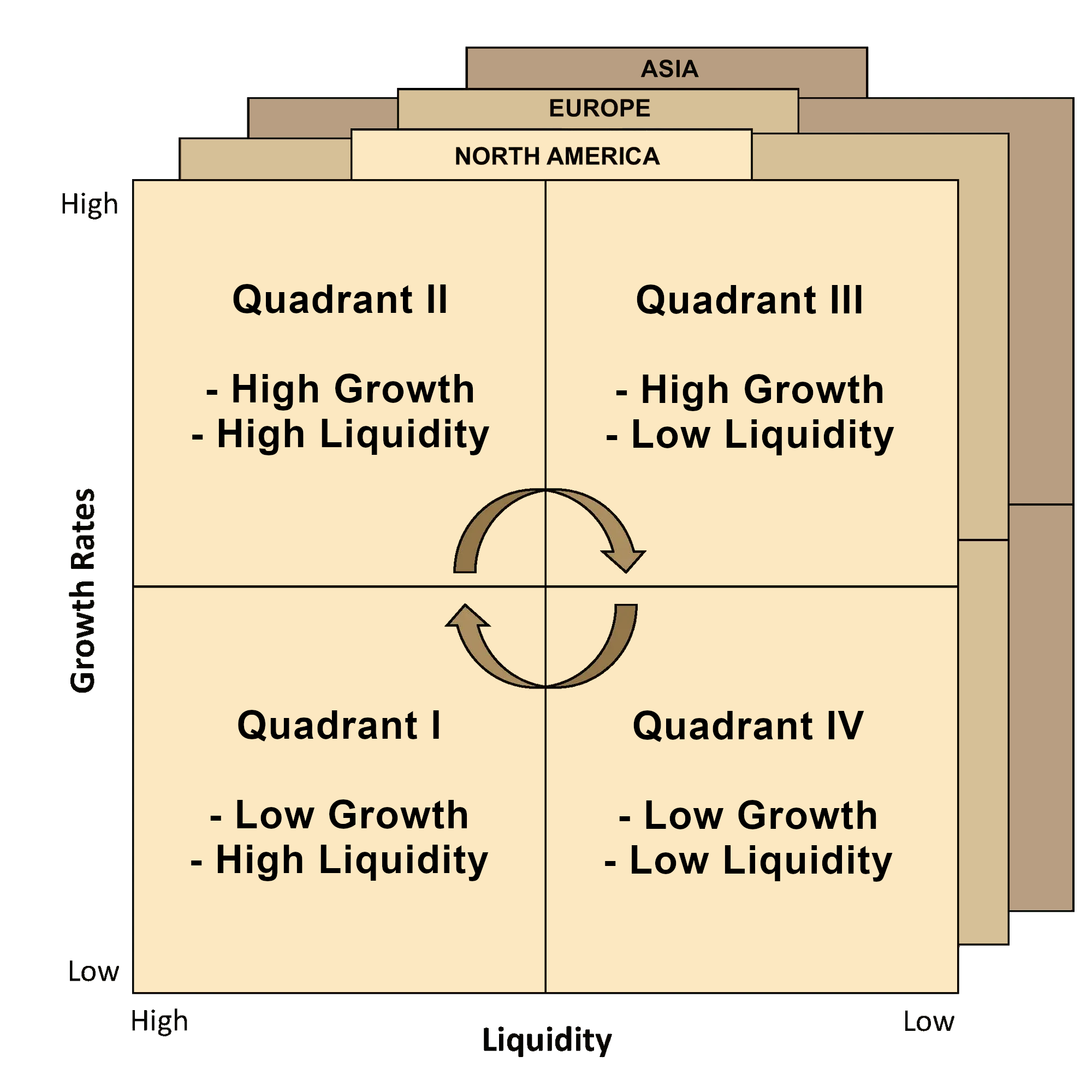

A typical economic cycle consists of four distinct quadrants largely segmented by two factors: the underlying growth rate of an economy and fiscal and monetary responses to that growth rate. A typical cycle moves clockwise through these quadrants.

Please click on the chart to learn more about our macro-economic cycle-based process.

Quadrant I

Cycles typically begin in Quadrant I, where the economic activity is weak and monetary policy is accommodative. Optimal performing strategies in Quadrant I: Global Macro, Event Driven, Distressed Debt.

Quadrant II

As economic activity increases, if monetary authorities maintain accommodative policies and credit remains non-restrictive, the Cycle enters Quadrant II, where optimal performing strategies include: Equity Long Only, Credit L/S.

Quadrant III

As the economy nears full capacity and credit becomes more restrictive, the Cycle enters Quadrant III (high growth, declining liquidity). Optimal strategies in Quadrant III include Event Driven, Quantitative Directional, and Equity Hedge.

Quadrant IV

The Cycle terminates in Quadrant IV, where the monetary authorities are attempting to slow economic activity with restrictive monetary policy. In Quadrant IV, exposures are minimized to protect against investment loss. Optimal strategies include long duration fixed income.

Our Investment Process: Product Scope

Once an asset allocation plan is developed, we employ professional, unaffiliated managers to express that viewpoint. We believe these managers have demonstrated superior historical performance vs. their relevant peer groups and are monitored on a continuous basis by Artemis. Artemis’ experience encompasses the full range of financial assets, both traditional and alternative.

Asset Class | Equity | Fixed Income | Hedge Funds | Private Equity | Real Assets |

Sectors | US International - Developed International - Emerging | Treasuries Corporates Municipals MBS High Yield International | Equity Long/Short Relative Value Distressed Global Macro Market Neutral | Venture Capital Leverage Buy-Out Mezzanine Capital Distressed Secondaries | Real Estate Commodities Infrastructure |

Investment Vehicles | Separately Managed Accounts Exchange Traded Funds | Separately Managed Accounts Exchange Traded Funds | Limited Partnerships | Limited Partnerships Direct Investments | Limited Partnerships Direct Investments |